The Only Guide for Whole Farm Revenue Protection

Wiki Article

A Biased View of Whole Farm Revenue Protection

Table of ContentsThe Buzz on Whole Farm Revenue ProtectionFascination About Whole Farm Revenue ProtectionSome Known Facts About Whole Farm Revenue Protection.The Definitive Guide for Whole Farm Revenue ProtectionUnknown Facts About Whole Farm Revenue ProtectionThe Definitive Guide to Whole Farm Revenue Protection

Jennifer as well as her family members run a 65-cow tie delay milk farm with a heifer barn and a pregnancy pen. The farm has been in her family for 2 generations, as well as they are dedicated to caring for the herd. Jennifer is considering broadening her operation by ten cows, and is trying to find insurance policy that will cover higher dollar quantities for plant food, gas, as well as other things her ranch makes use of frequently.

Jennifer is planning ahead regarding things such as waste contamination and also other potential air pollution dangers. If waste from her cattle contaminates a close-by body of water, Jennifer is legally in charge of the clean-up. She's also had a couple of good friends who have actually had injuries to their animals when they obtain stuck in stalls, so she wishes to check out insurance coverage that guards her farm versus the expenses associated with entrapment.

The smart Trick of Whole Farm Revenue Protection That Nobody is Talking About

Entrapment Broad Form covers these animals versus entrapment in stalls or various other areas. For dairy procedures, the coverage should get on the whole bleeding herd rather than simply one or a couple of livestock. 3rd party physical injury, clean-up costs, as well as building damage triggered by a contamination incident are all covered under our special air pollution insurance.While each policy is unique, many farm plans do share some usual terms or qualities. The following is a conversation clarifying the more general parts of a farm insurance coverage. Comprehending the different parts of a policy as well as the ideas of the policy can assist to far better evaluate a policy to identify if it supplies ample insurance coverage for a farm.

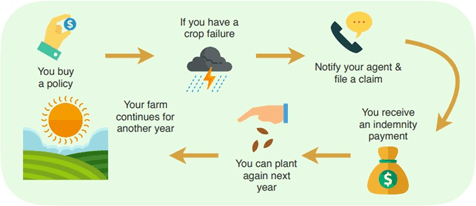

The policy holds the insurance company liable for paying the guaranteed for eligible claims. Moreover, the contract requires the insured to meet certain responsibilities such as the prompt reporting of insurance claims. Once the plan comes to be energetic, both the insurer and also the guaranteed are legitimately bound to the regards to the plan.

Some Ideas on Whole Farm Revenue Protection You Need To Know

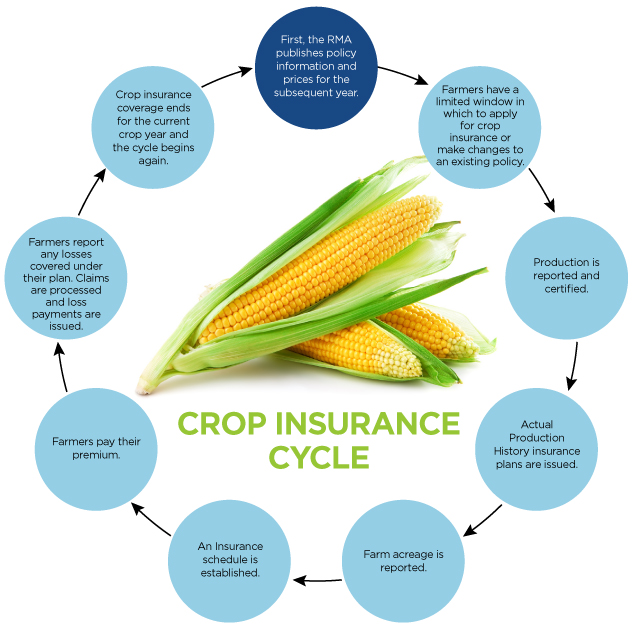

In the event of damages or destruction of a ranch property as a result of a protected peril, the insurance provider will certainly pay at the very least some, but necessarily all, of the value of the covered property to the farm operation. Standard Protection. A plan that offers standard protection is just going to cover the guaranteed for called dangers.

Unique Protection. Unique coverage is the most thorough coverage readily available. Unlike basic as well as wide coverage, unique coverage includes every little thing other than the identified exemptions. Rather of determining the risks covered, special protection uses insurance coverage to everything except what is particularly recognized as an exception. Special protection gives much more detailed insurance coverage because whatever is consisted of unless excepted.

The Greatest Guide To Whole Farm Revenue Protection

It is essential to recognize what properties are covered under which sort of coverage. Special coverage is best for the most thorough protection, however specialcoverage is likewise more expensive than standard and also wide insurance coverage. Weighing the added expense of special coverage versus the advantage of detailed coverage given is a vital analysis to be done for each insurance coverage.

Call an representative to figure out even more about Agriculture insurance coverage.

Getting The Whole Farm Revenue Protection To Work

As each farm is unique, often tends to be highly personalized, beginning at the minimum amount of coverage as well as obtaining more individualized relying on the needs of your house or organization. It is used to secure your ranch investments, and not just shields your main farm however additionally your home. If farming is your full-time profession, ranch proprietor's insurance is a wise investment.Though, this standard insurance should be tailored perfectly to fulfill the requirements of your farm. Thankfully, an insurance agent will have the ability to aid you establish what fits your ranch! When considering if farm or ranch insurance appropriates for you, we recommend taking any additional frameworks on your land, income-earning animals, and also any type of workers into consideration.

Your farmhouse isn't check that the only high rate thing you have, as well as since of that, on-site equipment such as tractors, trailers, and others need to be factored in. This rate normally reduces as your equipment diminishes. For a conventional farm and cattle ranch plan, the typical price is determined based on your area, procedures, declares history, and also a lot more.

The Buzz on Whole Farm Revenue Protection

Ranch items that have actually been planted are not covered by ranch insurance policy and also rather are generally covered by a commercial insurance plan if the quantity of sales surpasses read the article your incidental earnings restriction. No matter just how numerous precautions you take, mishaps can still take place to even one of the most experienced farmers. As an example, if a pet were to leave the ranch and trigger a crash, you would be responsible for the crash as you are the pet's owner.If you are interested in discovering even more concerning farm or ranch protection and other available residential or commercial property insurance policy plans, call our insurance agency to speak to one of our knowledgeable insurance policy agents!.

Report this wiki page